Lisa Kramer — Bixby PLAC Co-Chair, OKPLAC Chair

I must admit I almost never buy anything without some sort of a discount. While a 5% discount is good, a 50% discount entices me to strongly consider making a purchase at my favorite stores. Of course, retailers know this about consumers like me. Discounting merchandise to increase sales is part of retailers’ business models with the ultimate objective of maximizing their net income.

Just like retailers, governments, including the State of Oklahoma, have a way to encourage their citizens into behaving a certain way; it is called a tax incentive. Tax incentives reduce the taxes paid by businesses and individuals who engage in specific desirable actions or make investments that are deemed to benefit the community or are considered socially responsible. In other words, the state has determined that the economic or social benefit resulting from the behavior required to earn the tax incentive is more valuable than the loss of revenue it foregoes in its general revenue fund.

Now, let’s look at two of the major types of tax incentives: deductions and credits. A tax deduction is a reduction of your income that is taxable. Deductions reduce your tax bill by a fraction. The lower your taxable income, the lower your tax bill. Common deductions include interest on your mortgage and charitable donations. In contrast, a tax credit is a dollar for dollar direct offset against your actual tax liability. Some credits are even refundable meaning the state will write you a check if your tax bill is lower than the amount of credits you have earned. Because they directly reduce the tax you owe, tax credits are much more expensive to the State and are usually limited in availability and amount.

The following is a general example that shows how a tax credit is significantly more valuable than a tax deduction.

Since we know that tax credits reduce the amount of revenue coming into the State’s Treasury, let’s examine a few of the twenty-nine tax credits offered to individuals and businesses and consider what specific objectives Oklahoma is encouraging.

Investment/New Jobs Credit increases property values or number of Oklahoma taxpayers providing more revenue to the State.

Poultry Litter Credit encourages the removal of poultry litter in environmentally sensitive areas.

Volunteer Fire Fighter Credit enhances public safety by encouraging citizens to serve as fire fighters in local communities.

Natural Disaster Credit provides financial relief for victims who have suffered property losses resulting from natural disasters.

You get the idea. Just as retailers offer discounts to achieve their profit goal, Oklahoma is offering tax incentives to achieve its general objective: to make Oklahoma a better place to live and work. To ensure that these credits are in fact financially beneficial to the State, the majority of these credits are subject to regular independent review by the Incentive Evaluation Commission (IEC).

Of Oklahoma’s twenty-nine credits available to businesses and individuals, there are only four that are earned by making very specific charitable contributions. To earn these tax credits, a taxpayer must make a charitable contribution for Cancer Research, Biomedical Research or under the Equal Opportunity Education Scholarship Act, to a Scholarship Granting Organization (SGO) or an Educational Improvement Grant Organization (EIGO). Because of the charitable nature of these credits, they are not evaluated by the IEC but they do deserve an in-depth look to ascertain how they are helping Oklahoma meet its objective.

1. What is the maximum donation that can be made to earn a tax credit under these programs?

Do you notice anything strange here? Wow, how did we go from $1,000 to $4,000 to $100,000? Why are businesses able to donate such a large amount in the case of Equal Opportunity Education Scholarships?

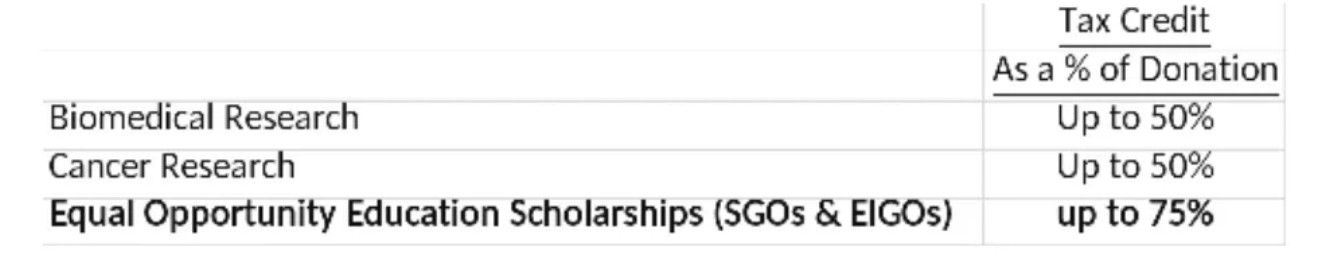

2. How much is earned in tax credits as a percent of the donation?

Are you starting to see a pattern here? The Equal Opportunity Education Scholarships sure do look like a good deal! In fact, contributions for Equal Opportunity Education Scholarships are eligible for a federal and state tax deduction before you get to deduct 75% of your contribution from your tax bill. Equal Opportunity Education Scholarship Tax Credits are the absolute richest tax credit offered by the State of Oklahoma.

3. Tax credits reduce the amount of tax revenue that the State has available to spend. Are there limits on the amount of credits that can be claimed on these charitable contribution tax credits?

Tax credits for Equal Opportunity Education Scholarships already exceed credits for cancer and biotech medical research by 400%. Now, Senate Bill 407 increases the cap on credits by an additional $15,000,000 and is ready for consideration by the Oklahoma House.

4. Does the increase in tax incentives help Oklahoma meet its objective?

The short answer is NO. Tax credits for donations for Equal Opportunity Education Scholarships are an ineffective means to make Oklahoma a better place to live and work and do not warrant expansion.

Under the Equal Opportunity Education Scholarship Act, individual and corporate donations are made to an intermediary that either provides scholarships to students who attend private schools (SGOs) or approves grants for innovative programs to smaller public schools (EIGOs). While there is no doubt that these contributions have assisted some students attending private schools and provided specific funding for a small number of public schools, Oklahoma’s goal of being a great place to live and work should start with providing a high-quality public-school system that is accessible by all students.

Rather than reducing the State’s limited revenue by increasing these already generous tax credits with Senate Bill 407, Oklahoma must conserve its tax base and invest all available revenue in critical core services including public education. To reduce class sizes and improve teacher recruitment and retention, public schools need recurring public funding not grants dependent on donors. By increasing the appropriation to the funding formula, all public-school students will benefit in an equitable manner and locally elected school boards will be able to best meet the needs of each school district.

I have occasionally bought something because it seemed like a great deal only to get home and realize it wasn’t what I actually needed. Similarly, this significant expansion of an already generous tax credit program for charitable contributions to private and public schools is not what Oklahoma needs right now. With last year’s historic teacher pay raise, Oklahoma’s support for public education is trending up. However, additional, sustained investments are needed to elevate Oklahoma from the bottom of regional per pupil spending and to offer the 700,000 public school students the quality education and resulting opportunities that will make Oklahoma a Top Ten State. Ask your legislators to vote NO on SB 407 and to focus the State’s limited resources on core services in which most Oklahoma citizens will benefit. Remember, you get what you pay for.

- Lisa Kramer, Oklahoma & Bixby PLACs

Kramer is a Certified Public Accountant and the mother of two Bixby High grads. She has served on the Bixby Board of Education since 2010. She is currently serving as Co-Chair of the Bixby PLAC and Chair for the OKPLAC.